The Year You Stop Guessing and Start Leading

Every December, founders tell me the same thing.

"This year went fast."

"We were busy."

"I think we had a solid year."

Then I ask a simple follow-up question.

"What does the data say?"

That is usually when the silence arrives.

Most founders finish the year with a sense of progress, but not a complete picture. Revenue grew, but cash felt tight. The team expanded, but operations never quite caught up. New opportunities appeared, but the business did not feel fully ready to take them on.

There is a reason for that.

Progress without clarity creates momentum that feels good while leaving you vulnerable. Real leadership requires something stronger. It requires looking behind the curtain of your own business and facing what is actually happening.

Ready Founders do that work in December.

This is the month when you slow down long enough to understand the story behind the numbers. This is when you decide whether the business you are running is truly the business you think you are running. And this is when you build the foundation that lets you enter January with intention instead of hope.

What Financial Leadership Looks Like at Year End

When I was running my tech company years ago, we finished what looked like a great quarter. Revenue was up. Clients were happy. The team was moving fast. From the outside, everything looked solid.

Then my banker called and asked a simple question: "How is your cash position?"

I had reports. I had spreadsheets. I could pull up balance sheets and P&Ls. But I could not answer the question with confidence.

That moment was a turning point.

I realized I was running a company that looked successful without having full clarity about the true position of the business. I was reacting to numbers instead of leading with them.

Many founders are in that same position every December. They have data but not clarity. They have activity but not alignment. They have numbers but not meaning.

Financial leadership begins when you stop looking at numbers as a task and start using them as instructions.

Three Questions Every Ready Founder Answers Before January

- What actually drove our results this year?

This is not about revenue or net income alone. It is about understanding the forces that shaped those results.

Which customers created the most value? Which services drained the most time? Which decisions paid off and which ones added noise? Where did cash enter and where did it slow?

When you answer these questions, you stop guessing about growth. You understand what you should repeat and what you should retire.

Most founders are surprised when they see it clearly. Success often hides weak spots. Challenges often hide progress. The goal is to see the truth so you can lead with intention.

- What is the real state of our cash flow?

Your bank balance tells you what happened. Your cash flow forecast tells you what is coming.

Some founders feel tight on cash because receivables are aging. Others feel strong while hidden liabilities wait to surface in Q1. Still others are profitable but cannot grow because money arrives too slowly to fund expansion.

A Ready Founder pulls three reports every month: P&L, balance sheet, and cash flow statement.

In December, those reports become the foundation for your January decisions. Without them, you enter the new year with hope instead of clarity.

- What is your business actually worth?

Here is the question most founders avoid: What would someone pay for your business today?

Not what you hope it is worth. Not what you think it should be worth. What would a sophisticated buyer actually pay based on market conditions right now?

This is not the same as tracking your KPIs. This is about understanding your enterprise value and what drives it.

Too many founders build strong businesses without tracking what makes those businesses valuable to someone else. They focus on growth metrics while missing the factors that actually drive valuation. When the time comes to sell, they discover that the market has shifted in ways they did not see coming.

I have watched this happen more than once. A founder builds for years, assumes their business will command premium offers when they are ready to exit, then discovers the landscape has changed. Maybe regulatory shifts created new compliance burdens. Maybe competitors flooded their space. Maybe the pool of strategic buyers who would have paid top dollar five years ago has simply moved on to different opportunities.

The business still sells. But the number is a fraction of what it could have been if the founder had been tracking enterprise value deliberately and building it systematically.

None of this is unpredictable. The signs are always there. But most founders are too busy running the business to step back and evaluate where they stand in terms of actual market value.

The Annual Valuation Discipline

This is why every Ready Founder should conduct an annual business valuation. Not just for potential exit planning, but because knowing your enterprise value informs every major decision you make.

I know what you are thinking. You are already tracking revenue, profit, cash flow, and a dozen other KPIs. Why add another metric to the pile?

Because valuation is different. It forces you to see your business through the eyes of someone who might buy it. And that perspective changes everything.

Here is what that discipline looks like:

Get a realistic valuation. Work with professionals who understand your industry. Get real numbers based on actual market conditions, not back-of-napkin calculations or hopeful projections.

This might feel like extra work. It might feel uncomfortable. Many founders resist this step because they do not want to face the gap between what they hope their business is worth and what it actually is worth today.

But you need permission to do this work. You need to give yourself space to look honestly at your enterprise value without judgment. If you don't know what you don't know, you cannot fix it.

Understand what drives your value. Revenue growth matters, but buyers care about different factors. Recurring revenue matters more than one-time projects. Customer concentration creates risk. Operational systems that work without you increase value. Clean financials ready for due diligence matter. A defensible market position matters.

Know which of these factors strengthen your valuation and which ones weaken it.

Study your competition. Do a proper SWOT analysis focused specifically on enterprise value. What are your most respected competitors doing that makes them more valuable? Where are you vulnerable?

This is not about copying their business model. It is about understanding what sophisticated buyers value in your market. What would make someone pay a premium for a business like yours? What would make them walk away?

Build your value increase plan. Once you know where you stand, create a specific plan to increase your valuation. Not someday. Starting now.

Maybe that means diversifying your customer base. Maybe it is systemizing operations. Maybe it is hiring that CFO you have been putting off. Maybe it is addressing a regulatory compliance gap before it becomes a deal-breaker.

Whatever it is, make it concrete. Track it. Report on it the same way you track revenue or profit.

Why This Matters Now

Markets shift. Regulations change. Competitors emerge. Strategic buyers come and go.

The founder who understands their business value and actively works to increase it is the one who gets to choose their exit timing. They are not forced to sell when conditions are unfavorable because they need liquidity or cannot keep up anymore.

They sell when they are ready. On their terms. At peak value.

This is not about planning to sell tomorrow. This is about being conscious and deliberate so you recognize the right moment when it arrives. The best time to sell is when you do not have to. And you only create that optionality by building enterprise value systematically, year after year.

You do not need to be thinking about selling to benefit from knowing your business value today. But when that moment comes, you want to be the founder who is ready, not the founder who wishes they had started this work five years earlier.

Are We Building a Business That Is Easy to Run or Hard to Run?

Growth is not the goal. Healthy growth is the goal.

A company that depends on the founder for every decision is hard to run. So is a company with unclear processes. So is a company without financial visibility.

A Ready Founder builds a business that is simple to understand, simple to measure, and simple to operate. Not easy, but simple. There is a difference.

This month, ask yourself whether the systems you created this year support your next level of growth. If not, this is the time to rebuild.

Why December Matters More Than January

Many founders treat December like the finish line. Ready Founders treat it like the starting line.

This is the month when tax planning still matters. This is the month when budgets can still be adjusted. This is the month when you choose the operating system that will guide your team.

This is also the month when you look at the full year and decide what stays, what shifts, and what stops completely.

By the time January arrives, the window for strategic change is very small. The rhythm of the year takes over. Clients return. Teams get busy. Urgency replaces intention.

December gives you space. January takes it away.

What Readiness Actually Looks Like in Practice

Over the years, I have seen the same pattern repeat itself with founders who appear to be doing everything right.

Growth accelerates. Pipelines fill up. Teams expand. From the outside, the business looks healthy and well run.

Then we slow down long enough to look closely at the year-end numbers.

Often, the fastest growing customer segment turns out to be the least profitable. The strongest customers are paying more slowly than expected. Pricing has not kept pace with rising costs. Cash feels tighter than it should given the level of activity.

When founders see this clearly, the path forward is rarely dramatic. Pricing gets adjusted where it should have been earlier. One or two segments are trimmed back. Payment terms are tightened. Financial visibility improves.

Nothing fundamental about the business changes. The product is still strong. The team is still capable. The opportunity is still there.

What changes is clarity.

And clarity is what allows leaders to act decisively instead of reacting late.

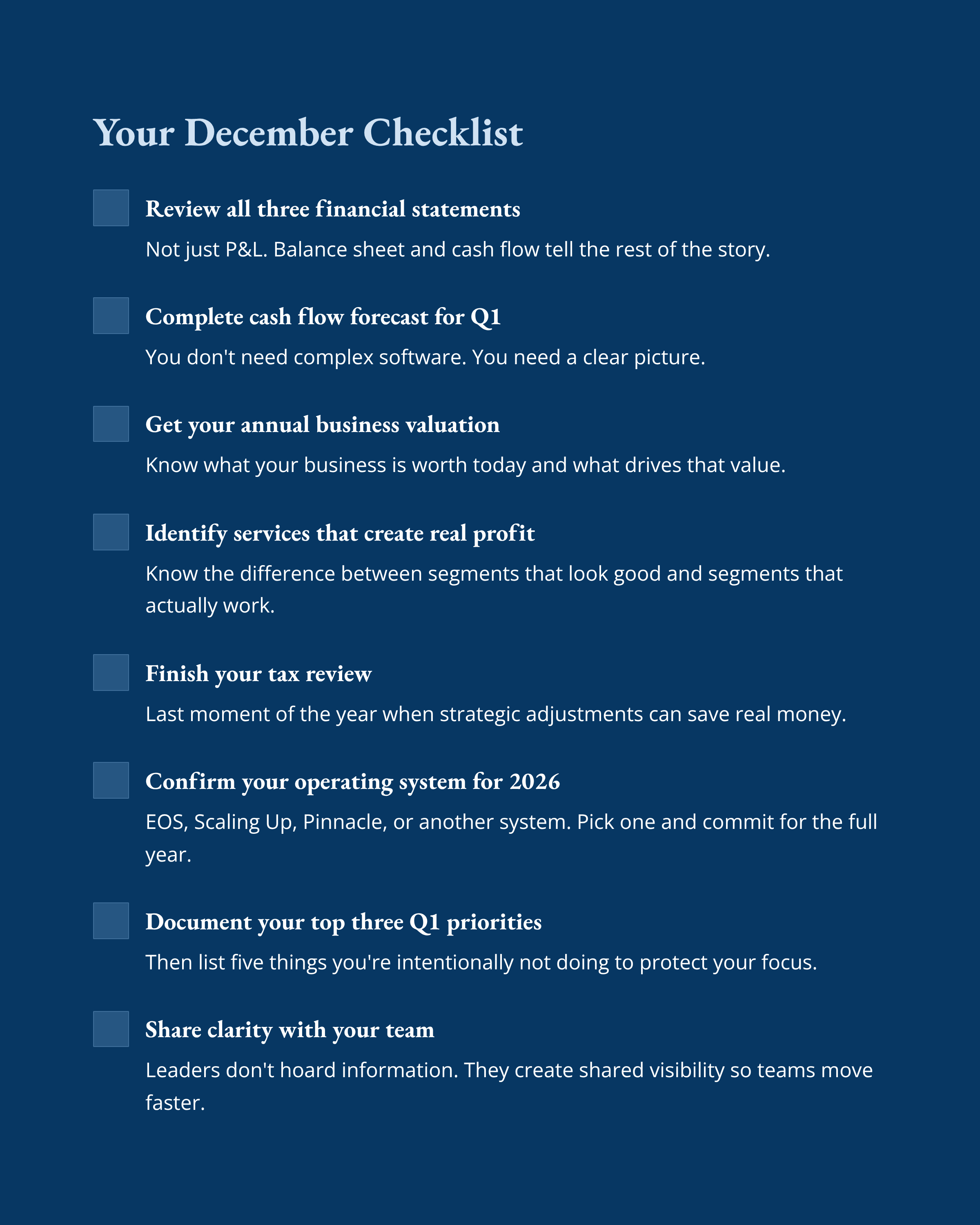

Your December Checklist

Here is the same process we use with our Ready Founder clients in December. It takes discipline, not complexity.

- Review all three financial statements Not just the P&L. The balance sheet and cash flow statement tell the rest of the story.

- Complete a simple cash flow forecast for January through March You do not need complex software. You need a clear picture.

- Get your annual business valuation Know what your business is worth today and what drives that value. If you have not done this yet, make it a priority before year end.

- Identify the services or customers that create real profit Every founder has segments that look good and segments that actually work. Know the difference.

- Finish your tax review This is the last moment of the year when strategic adjustments can save real money.

- Confirm your operating system for 2026 EOS, Scaling Up, Pinnacle, or another system. Pick one and commit for the full year.

- Document your top three priorities for Q1 Then list five things you are intentionally not doing so you can protect your focus.

- Share the clarity with your team Leaders do not hoard information. They create shared visibility so the team can move faster.

Click ↑ to download your December checklist.

A Personal Reflection for the Year

I have met hundreds of founders through the Ready Founder and MilCom communities this year. Every one of them is building something that matters. Some are expanding. Some are rebuilding. Some are facing the hardest year of their career.

The ones who move forward with confidence share one thing. They choose clarity when the rest of the world chooses noise.

That choice changes everything. It changes how you hire. It changes how you grow. It changes how you sleep at night. It changes how you show up for your family.

Readiness is not a talent. It is a choice you make every day.

If this year wore you out, let next year build you up. Use December to step back, see your business clearly, and lead from a position of strength.

Your future self will thank you.

Ready to close the year with clarity? Let's talk about building your enterprise value plan for 2026. Schedule a conversation

About the Author: Rod Loges is CEO of One Degree Financial and host of the MILCOM Founders podcast, where he helps veteran entrepreneurs build businesses with strong financial foundations.